401k cash out penalty calculator

401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator Print Share Use this calculator to estimate how much in taxes you could owe if. NerdWallets 401 k retirement calculator estimates what your 401 k balance.

How To Calculate The Income Taxes On A 401 K Withdrawal Sapling

If you start taking money out of your 401 k early youll pay taxes of 20 percent of what you withdraw.

. Penalties And Taxes On Cashing Out A 401k. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. As mentioned above this is in addition to the 10 penalty.

For example if you are looking. When you complete a 401k cash out you will need to pay an early withdrawal penalty and 401k taxes on your withdrawal. 401K Cash Out Penalties Learn when you are subject to penalties for taking money out of your 401K account and when you can withdraw penalty-free.

The money you withdraw from your 401k is taxed at your normal taxable income rate. Traditional or Rollover Your 401k Today. Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax.

While it may seem tempting to cash out your retirement plan money for emergencies or short-term expenses know that you could lose a significant portion of that. Additionally some 401k plans allow you to borrow from the plan usually up to 50 of the vested account balance with a maximum of 50000 that must be repaid within five. Most times when you cash out only 10 of the.

If you withdraw money from your 401 k before youre 59½ the IRS usually assesses a 10 penalty when you file your tax return. Strong Retirement Benefits Help You Attract Retain Talent. The calculator inputs consist of the retirement account.

Call us at 1-888-695-4472. If all of your contributions were made on a pre-tax basis such as with a 401 k or traditional IRA the calculation is easy. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity.

This is a hypothetical illustration used for informational purposes only and reflects 10 federal income tax rate and 0 state income tax rate plus a 10 IRS early. A 401 k account is an easy and effective way to save and earn tax deferred dollars for retirement. Using this 401k early withdrawal calculator is easy.

As long as you dont qualify for an exception your. Ad If you have a 500000 portfolio download your free copy of this guide now. Open an IRA Explore Roth vs.

So if you take 20000 out of your 401 k before you reach 59 12 youll. That could mean giving the government. This cash out calculator can be used to estimate the gain or loss when cashing out a retirement plan such as a 401k or 403b account.

Ad Build Your Future With a Firm that has 85 Years of Retirement Experience. A good rule of thumb is to expect to lose about half of your money to taxes and penalties at the federal and state levels.

Cashing Out Your 401 K Why It S A Bad Idea

How A 401 K Loan Could Cost You 150k In Retirement Savings Smartasset

How To Analyze And Optimize Your 401 K Free 401 K Analysis Tools

Should You Make Early 401 K Withdrawals Due

Retirement Withdrawal Calculator How Long Will Your Savings Last 2020

401k Calculator Withdrawal Collection Cheapest 56 Off Aarav Co

401 K Withdrawal Calculator Nerdwallet

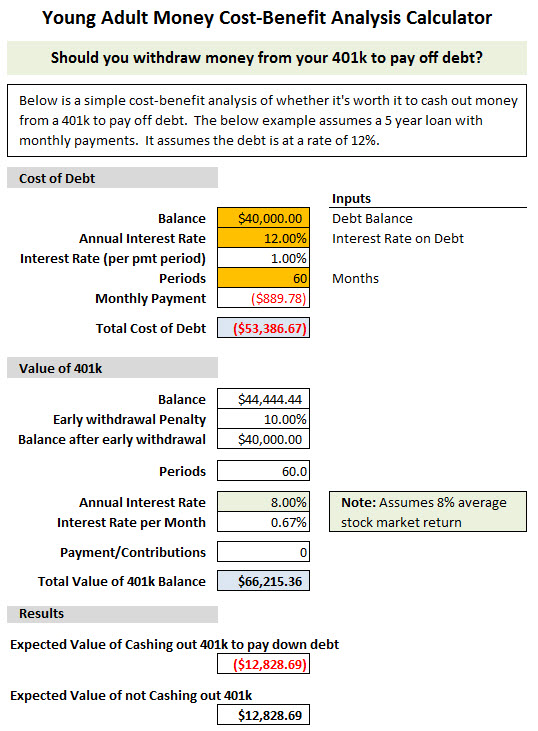

Should You Cash Out Your 401k To Pay Off Debt Free Calculator Download Young Adult Money

401k Calculator Withdrawal Collection Cheapest 56 Off Aarav Co

401k Calculator

Cashing Out Your 401 K What You Need To Know

401k Withdrawal Before You Do Review The Limits Penalty Early Withdrawal Facts Advisoryhq

Retirement Withdrawal Calculator For Excel

/what-to-know-before-taking-a-401-k-hardship-withdrawal-2388214-v2-211c0d162ae64a95bbe3813f1f9243ad.png)

401k Calculator Withdrawal Collection Cheapest 56 Off Aarav Co

Bear Markets And Your 401 K

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account